The Internal Revenue Service (IRS) has released the new income tax brackets for 2024, and it's essential to understand how these changes may impact your tax liability. According to a recent report by

CNBC, the IRS has adjusted the tax brackets to account for inflation, which may result in lower tax bills for some taxpayers. In this article, we'll break down the new income tax brackets for 2024 and what you need to know.

Understanding the New Tax Brackets

The IRS uses a progressive tax system, which means that different levels of income are taxed at different rates. The new tax brackets for 2024 are as follows:

10%: $0 to $11,600 (single) or $0 to $23,200 (joint)

12%: $11,601 to $47,150 (single) or $23,201 to $94,300 (joint)

22%: $47,151 to $100,525 (single) or $94,301 to $201,050 (joint)

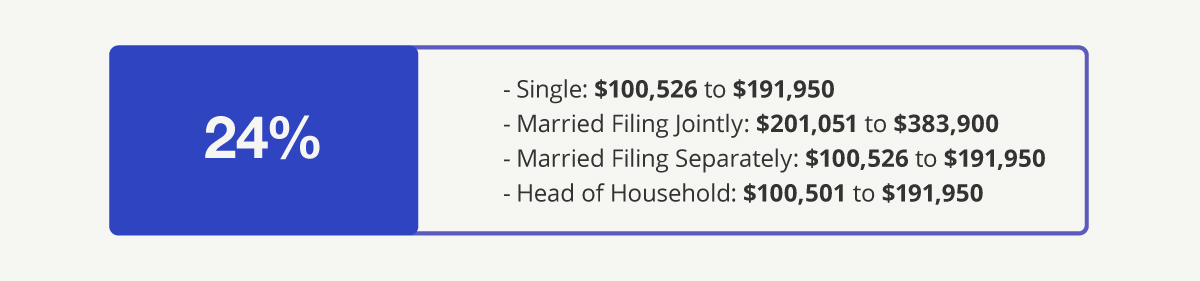

24%: $100,526 to $191,950 (single) or $201,051 to $383,900 (joint)

32%: $191,951 to $243,725 (single) or $383,901 to $487,450 (joint)

35%: $243,726 to $609,350 (single) or $487,451 to $731,200 (joint)

37%: $609,351 or more (single) or $731,201 or more (joint)

How the New Tax Brackets May Impact You

The new tax brackets for 2024 may result in lower tax bills for some taxpayers, particularly those in the lower and middle-income brackets. However, it's essential to note that these changes may not necessarily translate to a lower tax bill for everyone. Other factors, such as deductions and credits, can also impact your tax liability.

To minimize your tax liability, consider the following strategies:

Contribute to a 401(k) or IRA, which can help reduce your taxable income

Take advantage of tax credits, such as the

Earned Income Tax Credit (EITC) or the

Child Tax Credit

Itemize your deductions, such as mortgage interest and charitable donations, if they exceed the standard deduction

The new income tax brackets for 2024 may result in lower tax bills for some taxpayers, but it's essential to understand how these changes may impact your individual tax situation. By taking advantage of tax credits and deductions, and contributing to a retirement account, you can minimize your tax liability and keep more of your hard-earned money. Consult with a tax professional or financial advisor to ensure you're taking advantage of all the tax savings available to you.

Note: This article is for informational purposes only and should not be considered tax advice. Consult with a tax professional or financial advisor to determine how the new tax brackets may impact your individual tax situation.

Keywords: IRS, income tax brackets, 2024, tax liability, tax credits, tax deductions, CNBC