Table of Contents

- Goldman Sachs Stock: First And Fast As Always (NYSE:GS) | Seeking Alpha

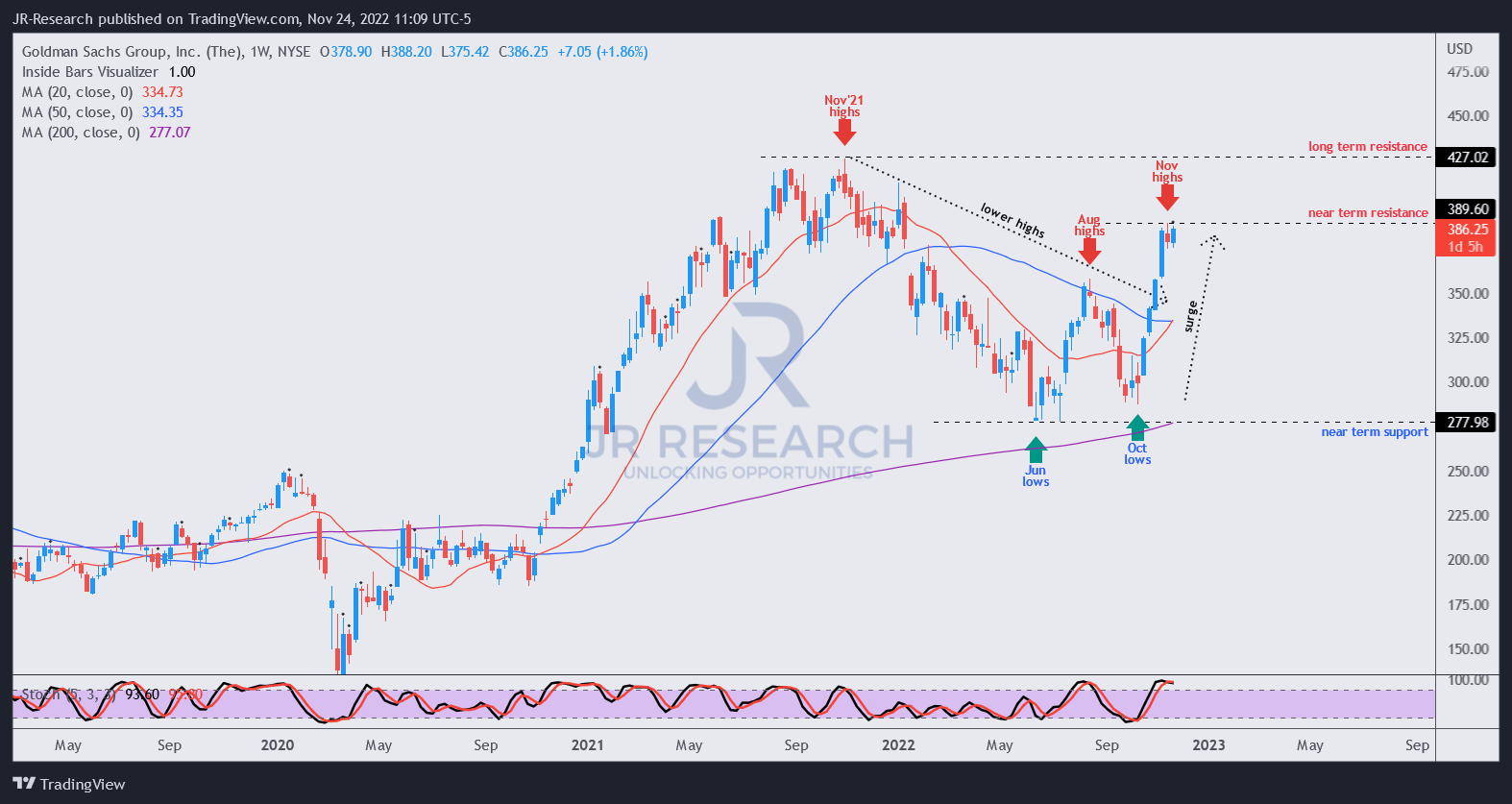

- Goldman Sachs (GS) Stock: Recent Rally Likely Shocked Bears | Seeking Alpha

- GS Stock Had A Different Swing Trading Strategy | Investor's Business Daily

- GS Stock Price and Chart — TradingView

- Goldman Sachs Stock Is Trading Below Its Intrinsic Value

- Produk GS____Official | Shopee Indonesia

- GS Stock Price and Chart — TradingView

- GS Stock Price and Chart — NYSE:GS — TradingView

- Premium Vector | GS brand vector round monogramAdobe Illustrator Artwork

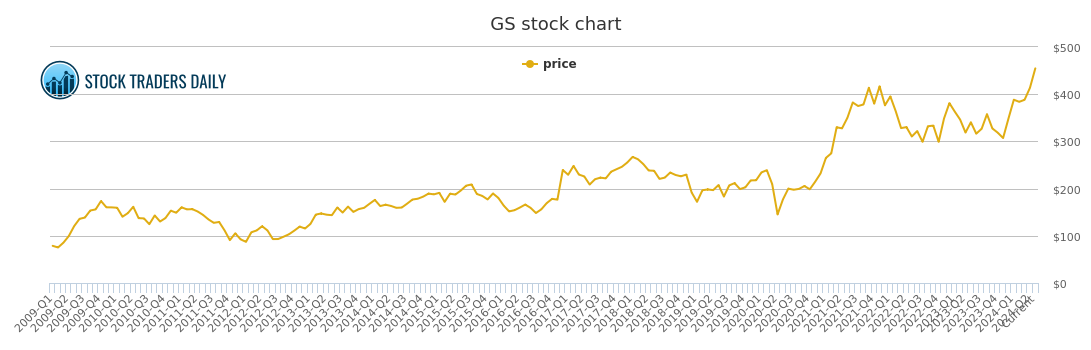

- GOLDMAN SACHS GROUP GS STOCK CHART

Current Performance

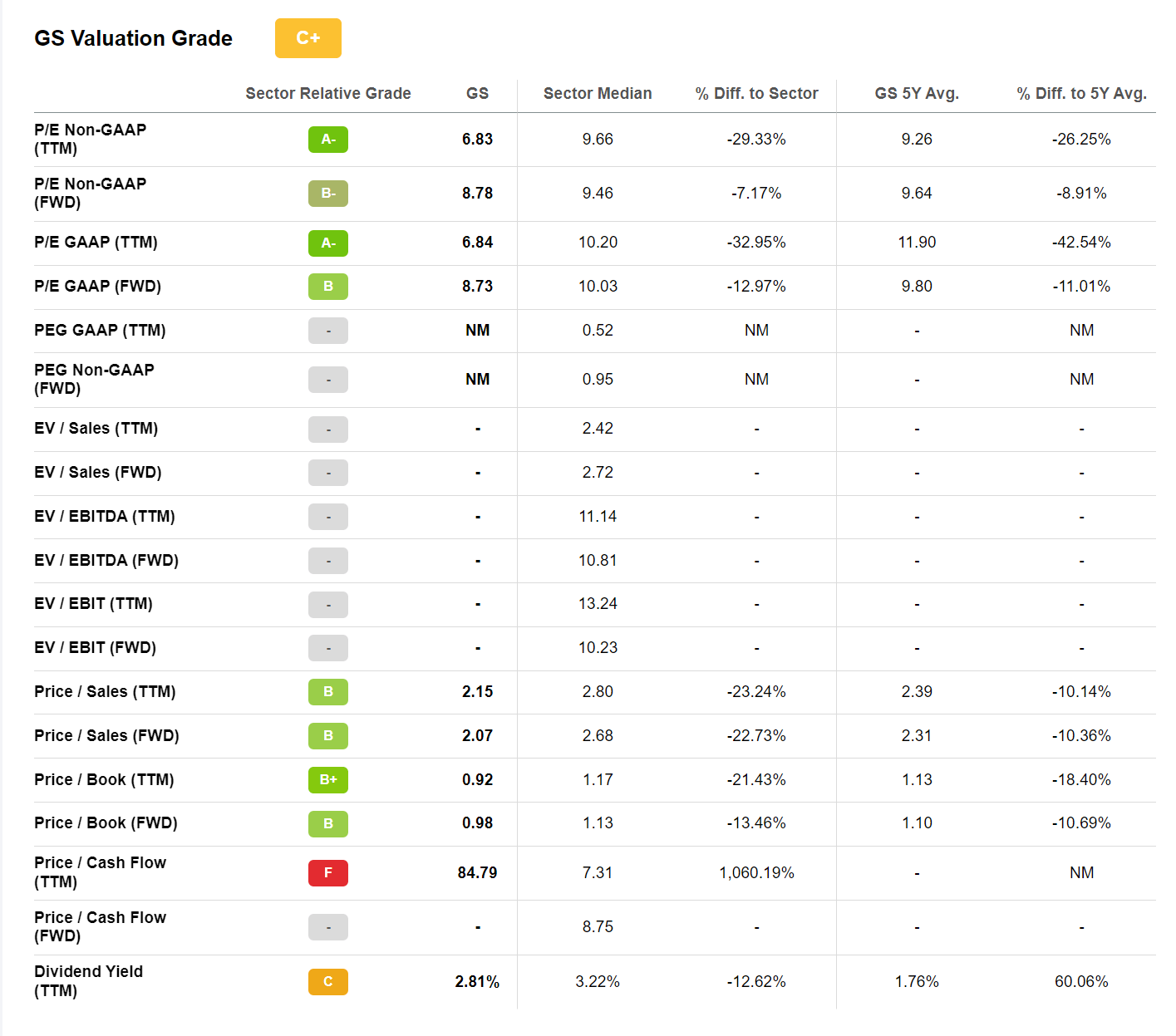

Key Metrics

Analysis

Goldman Sachs Group, Inc. (The) Common Stock (GS) has a strong track record of delivering solid earnings and revenue growth. The company's diversified business model, which includes investment banking, asset management, and securities, provides a stable foundation for long-term growth. Additionally, Goldman Sachs has made significant investments in digital transformation, including the launch of its consumer banking platform, Marcus. However, the stock is not without risks. The financial industry is highly regulated, and changes in regulatory policies can impact GS stock performance. Furthermore, the company's exposure to global market volatility and economic uncertainty can also affect its stock price.

Outlook

Looking ahead, Goldman Sachs Group, Inc. (The) Common Stock (GS) is poised for continued growth. The company's strong brand, diverse business model, and commitment to innovation position it well for long-term success. With a solid dividend yield and relatively low valuation, GS stock may be an attractive option for income-seeking investors. In conclusion, Goldman Sachs Group, Inc. (The) Common Stock (GS) is a compelling investment opportunity for those looking to tap into the financial industry's growth potential. With its rich history, diversified business model, and strong brand, GS stock is well-positioned for long-term success. As the stock continues to trade in real-time, investors can monitor its performance and make informed decisions based on the latest market trends and analysis.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with financial experts before making any investment decisions.